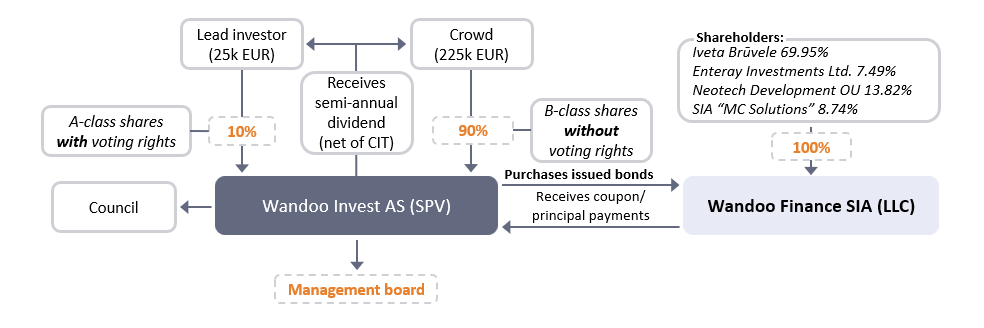

This is a debt security fixed income investment product, managed through Wandoo Invest AS, a special purpose vehicle (SPV). Investors acquire shares in the SPV by participating in this campaign. When the campaign reaches its funding goal, the SPV will invest in Wandoo Finance under an equity investment agreement with a 15% annual interest rate (11.25% expected annual return after tax) and quarterly payments over a fixed 2-year term. Once quarterly payment is received, SPV distributes dividends to the shareholders deducting income tax and related costs.

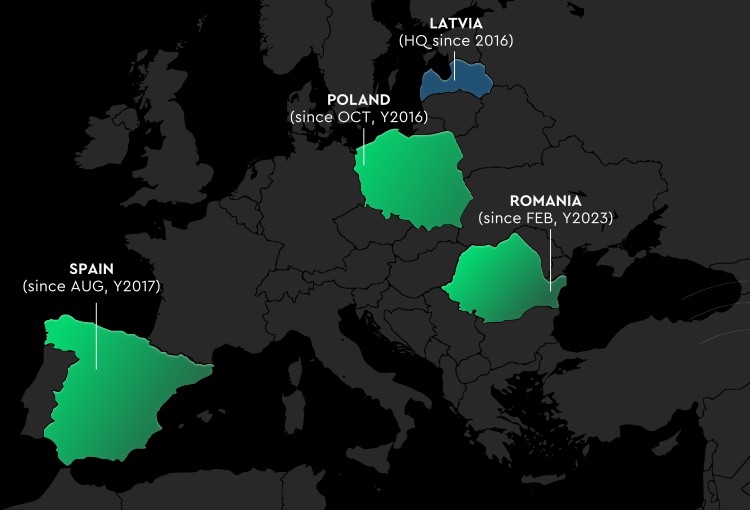

Wandoo Finance has streamlined microloan solutions using advanced machine learning for risk evaluation and an automated system. Serving clients across Spain, Latvia, Poland, and Romania, Wandoo Finance is transforming how microloans work, supporting financial inclusivity for a diverse range of customers.

Since its inception in 2016, Wandoo Finance has been at the forefront of the European fintech revolution, offering innovative microloan solutions to over 200,000 active clients across Spain, Latvia, Poland, and Romania. With more than €500 million in loans issued, Wandoo Finance is dedicated to enhancing financial inclusivity and empowering individuals to reach their financial aspirations.

Why Invest in Wandoo Finance?

- Innovative Solutions: Wandoo Finance harnesses the latest in technology to provide diverse and tailored loan options, ensuring clients' unique financial needs are met efficiently.

- Proven Success: A solid track record of issuing €500 million in loans since company inception in 2016 underscores Wandoo Finance's commitment to sustainable growth and investor returns.

- Expert Leadership: A seasoned team, with years of combined expertise in finance and technology, steers Wandoo towards continuous innovation and success.

Investment Opportunity

Join in transforming the future of finance. Wandoo Finance is not just a company Group; it is a movement towards smarter, more accessible financial solutions for everyone. Invest today and be part of journey to financial empowerment.

Use of Funds

This strategic infusion of funds will be allocated towards key areas to ensure sustainable growth and operational excellence. Here's how Wandoo Finance plans to utilize the funds raised through this campaign:

- Portfolio Growth in Poland & Spain: A significant portion of the investment will be directed towards expanding Wandoo Finance's loan issuance capacity in these markets. This expansion is crucial for increasing market share and enhancing revenue streams.

- Enhancing Machine Learning Capabilities: Investment in cutting-edge machine learning technologies will further refine Wandoo's credit scoring models, reducing default rates and optimizing loan approval processes. This technological advancement supports Wandoo's commitment to providing accessible financial solutions while maintaining a robust risk management framework.

- Operational Excellence and Efficiency: Funds will also be allocated towards improving operational processes, including customer service platforms and loan management systems. This investment in operational infrastructure is designed to streamline Wandoo's services, making them faster, more efficient, and customer-friendly.

- Marketing and Customer Acquisition: To continue growing their customer base, Wandoo Finance will invest in targeted marketing campaigns and strategic partnerships. This will enhance their visibility in existing markets and potentially open new avenues for expansion.

- Compliance and Regulatory Enhancements: As Wandoo Finance operates in the highly regulated financial sector, part of the funds will be used to ensure compliance with evolving regulatory requirements across different jurisdictions. This includes investing in legal and compliance frameworks to safeguard operations and customer interests.

Investment Structure

Calculation of the Nominal Interest Rate

The example for calculation of the nominal interest rate per year under the investment agreement for vested shares between Wandoo Invest AS and Wandoo Finance SIA.

Interest Rate: 15% gross per annum during the full term.

Interest Calculation: for the calculation of interest, the month is set at 30 days and the year at 360 days.

Date from which interest is due: No later than 30th of July, 2025.

Due dates for interest payments: Interest payments will be made quarterly on March 30, June 30, Septemeber 30 and December 30 of each year.

Initial investment repayment: The repayment of the initial investment will be made on the last payment date as the payment of interest.

Please note that above interest rate calculation is subject to income tax and SPV administration deductions. The applicable yield to investors before SPV administration costs is 11.25% (15% divided by a coefficient of 0.8 and multiplied by 20% CIT*).

*according to the Enterprise Income Tax Law section 3(1)).

Dividends and Exit Scenarios

This is a debt security investment product with a 15% gross annual interest rate and quarterly payments over a fixed 2-year term. Possible exit scenarios for the investors could be repurchase of the investors’ shares, reduction of the share capital or after the end term of the investment agreement for vested shares SPV would be liquidated.

Questions?

For any inquiries regarding the Wandoo investment campaign, please send your questions to [email protected].

With a rich background in fintech and a knack for driving sales and implementing innovative solutions, experience in Fintech of more than 12 years working as Head of customer service at 4Finance,

Regional manager at TWINO. She Founded Wandoo Finance in 2016

A visionary in financial services, Krišjānis has worked in Finance and banking for 9 years, continued with 4.5 years of Fintech industry, being CEO of Eleving group businesses in Latvia. Recently joined Wandoo Finance as CEO.

With deep expertise in risk management, Arvis has16 years’ experience in FinTech and finance with main focus on fraud, lending and credit risk management. Previously CRO Europe for Robocash, responsible for their Russian (Zaymer), Kazakhstan and Spanish markets.

Working in fintech industry since 2012 as Head of customer service at Creamfinance, Business development manager at SOHO Group. COO at Wandoo Finance since 2019.