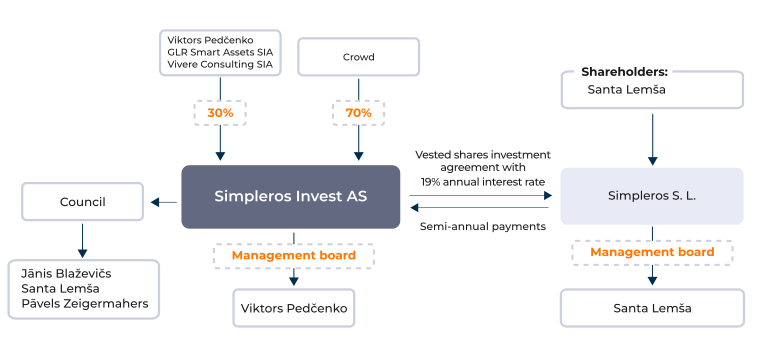

This is debt security investment product, managed through Simpleros Invest AS, a special purpose vehicle (SPV). Investors acquire shares in the SPV by participating in this campaign. When the campaign reaches its funding goal, the SPV will invest in Simpleros S.L. under a vested shares investment agreement with a 19% annual interest rate (14.25% expected annual return after tax) and semi-annual payments over a fixed 2-year term. Once semi-annual payment is received, SPV distributes dividends to the shareholders deducting income tax and related costs.

Simpleros has streamlined the process for people to get personal loans. Using advanced machine learning for evaluating risks and a fully automated system from InGain, Simpleros is transforming how personal loans work. The company serves a wide range of customers, from young adults to seniors, in various jobs.

INVESTMENT HIGHLIGHTS

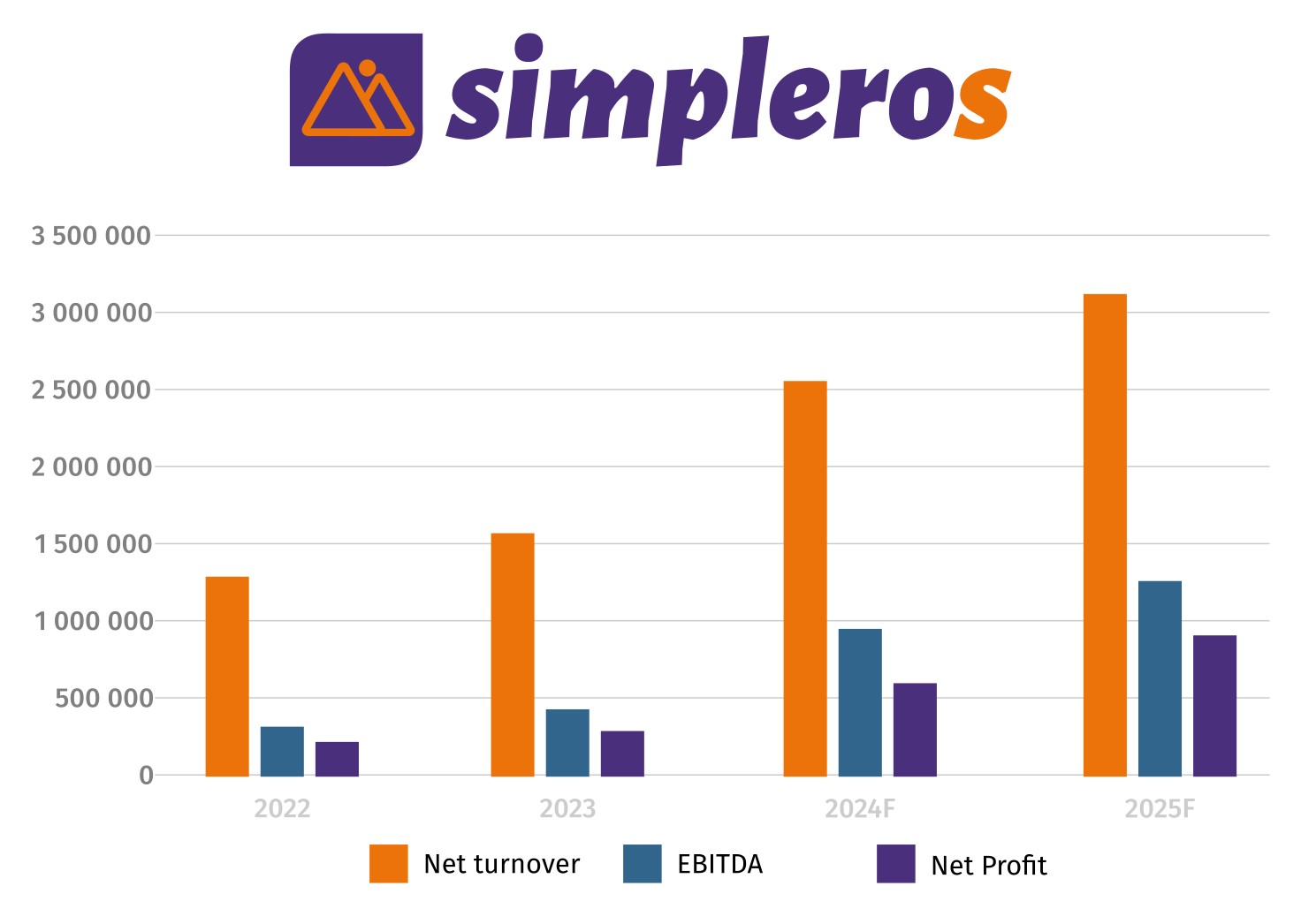

- Explosive Revenue Growth: Revenue is projected to escalate from 271,522 EUR in 2021 to 1,562,812 EUR in 2023, and further to 3,177,801 EUR by 2025.

- Solid EBITDA Margins: EBITDA is expected to reach 30% by 2023 and to improve up to 40% by 2025.

- Rising Profitability: Projected net profit of 310,353 EUR in 2023, growing to 866,649 EUR in 2025.

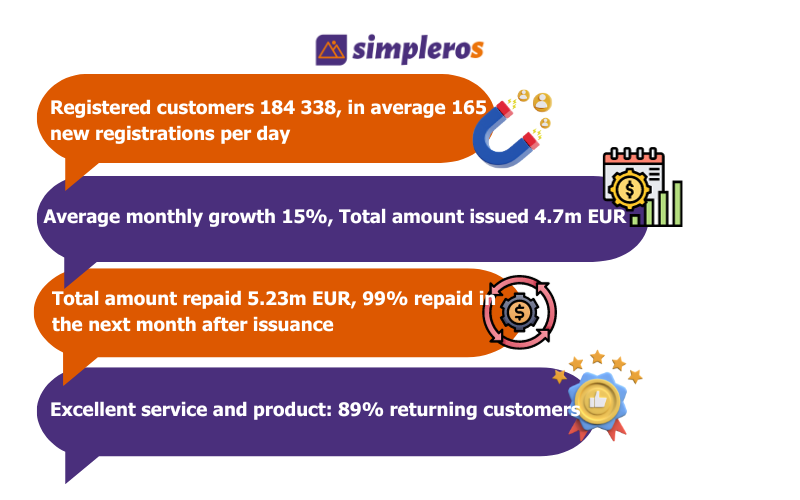

- Growing Customer Base: On average, 165 new customers register daily. Currently, over 184,338 users with an 18.6% loan approval rate.

- Notable Loan Growth: Monthly loan issuance growing by 15%. More than 39,303 loans issued, totaling over 4.7 million euros.

- Advanced Risk Management: Simpleros uses advanced machine learning to assess risks effectively. This helps maintain a strong quality of their loan portfolio and meet their strategic goals. Simpleros, primarily focusing on Spain, uses InGain software for potential global expansion.

COMPANY PROFILE

Simpleros is an online lending company based in Spain, successfully operating since October 2020. Led by a team with over 15 years of industry experience, it has attracted a large user base, with over 184,338 active clients. The company's rigorous application process ensures a high repayment rate and a low default risk.

PRODUCT AND SERVICES

Simpleros makes getting personal loans fast and easy. The entire process, from applying to getting funds, takes just 15 minutes. Identity verification is done securely online. Once approved, the loan is quickly transferred. Returning customers can easily choose their loan amount and term through a user area.

Simpleros offers loans up to 365 days and up to 1000 EUR, now also providing installment loans. The average loan size is 500 EUR. There is insurance options for accidents and income protection. With a 89% customer return rate, the company is expected to significantly increase revenue, projecting 3,177,801 EUR by 2025.

SALES STRATEGY

Simpleros focuses on simple and transparent sales methods. It uses data-driven, automated systems to make the loan process quick and efficient, taking only 15 minutes from application to funding. This fast service is a key part of their strategy.

Simpleros' pricing is based on risk, calculated using advanced Machine Learning models. These models look at many factors like credit history and income. This helps to set fair interest rates for each customer, based on their risk level.

New Customer Attraction Strategy

Simpleros attracts new customers mainly through Google Ads, using data for better targeting, and partnerships with affiliates. It has a user-friendly online presence, showing its competitive rates clearly. These strategies help increase the company's visibility online in Spain and bring in new clients efficiently.

Repayment Options

Simpleros offers flexible repayment options. Customers can adjust their loan repayment schedule to suit their financial situation. This flexibility is a part of Simpleros’ customer-friendly approach.

Customer Service Enhancements

Simpleros offers flexible repayment extensions, used by 16% of customers. The company has effective debt collection strategies, ensuring early repayment from 17% of customers and providing payment plans for 11% of those with delayed payments.

MARKET SIZE

The microloan market in Spain grew by 25% between 2019 and 2021, from €1.2 billion to €1.6 billion. This growth is due to the increasing popularity of online lending. Simpleros has made a significant impact in this market, with over 184,338 customers and a loan approval rate of 18,6%.

FINANCIAL PROJECTIONS AND HIGHLIGHTS

The financial outlook for Simpleros looks promising:

- Revenue Growth: There's an expected jump in revenue from 1,562,812 EUR in 2023 to 3,177,801 EUR by 2025.

- Net Profit Surge: Profits are also on the rise, with projections showing 310,353 EUR in 2023, increasing significantly to 866,649 EUR in 2025.

- EBITDA and Margins: EBITDA, a measure of overall financial performance, is expected to be EUR 461,811 by 2023. By 2025, it is expected to increase to EUR 1,264,447, with profit margins improving to 40%.

- Cash Flow Improvement: Even with the company's growth and expansion, the net cash flow from operations has improved, indicating good financial health.

Simpleros' income stream demonstrates the company's ability to meet all its obligations to investors.

INVESTMENT DISTRIBUTION PLAN

To join Simpleros' crowdfunding campaign, the minimum investment is 100 EUR. The campaign uses a Special Purpose Vehicle (SPV) called Simpleros Invest AS to manage the funds effectively and transparently.

Use of Funds

Funds raised through this crowdfunding campaign will be primarily used to:

- Expand Loan Issuance Capacity: The goal is to increase the number of loans Simpleros can issue. This aligns with expected higher loan loss provisions, estimated at 604,775 EUR for 2023 and 1,255,052 EUR by 2025.

- Invest in Operational Expenses: This includes covering both direct and indirect operating costs. For 2023, direct operating expenses are estimated at 438,467 EUR and indirect expenses at 79,084 EUR. By 2025, these are expected to rise to 571,021 EUR and 120,477 EUR respectively.

- Marketing and Customer Acquisition: A significant part of the funds will be invested in marketing activities and reaching out to new customers. The budget for this is planned to be 162,886 EUR in 2023, increasing to 181,444 EUR in 2025.

- Enhance Machine Learning Capabilities: The campaign will also fund improvements to Simpleros' machine learning technology, which is crucial for better risk assessment and the long-term success of the company.

INVESTMENT STRUCTURE

Investors via the crowdfunding platform will hold a majority share in the SPV, which in turn will invest in Simpleros. All financial operations will be transparently managed to safeguard investor interests.

- Investors via CrowdedHero platform invest in Special Purpose Vehicle (SPV) - Simpleros Invest AS. Investors will hold 70 % of Simpleros Invest AS.

- CrowdedHero investors’ interests in the SPV Supervisory Board will represent CrowdedHero Board – Jānis Blaževičs.

- SPV conludes Vested shares investment agreement under 19% annual interest rate with semi-annual payments and transfers funds to Simpleros S.L. under fixed post-money valuation 2 125 000 EUR (equals 11.76 % of equity of Simpleros S.L. company). Crowd investors will indirectly own 8.24 % of Simpleros S.L. if Simpleros S.L. fails to fulfil its obligations under the Vested Shares Investment agreement.

- Simpleros S.L. will semi-annually pay 19% under vested share investment agreement to SPV, which will further distribute dividends accordingly ownership part to every crowd investor deducting income tax and related costs.

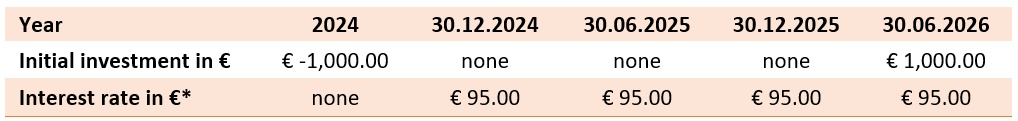

Calculation of the nominal interest rate per year

The example for calculation of the nominal interest rate per year under the investment agreement for vested shares between Simpleros Invest AS and Simpleros S.L.

Interest Rate: 19% gross per annum during the full term.

Interest Calculation: for the calculation of interest, the month is set at 30 days and the year at 360 days.

Date from which interest is due: 30th of December, 2024.

Due dates for interest payments: Interest payments will be made semi-annually on December 30 and June 30 of each year.

Initial investment repayment: The repayment of the initial investment will be made on the last payment date as the payment of interest.

For an investment in the amount of 1,000 EUR, the following interest and redemption schedule results as an example:

Please note that above interest rate calculation is subject to income tax and SPV administration deductions. The applicable yield to investors before SPV administration costs is 14.25% (19% divided by a coefficient of 0.8 and multiplied by 20% CIT*).

*according to the Enterprise Income Tax Law section 3(1)).

Dividends and Exit Scenarios

This is a debt security investment product with a 19% gross annual interest rate and semi-annual payments over a fixed 2-year term. Possible exit scenarios for the investors could be repurchase of the investors’ shares, reduction of the share capital or after the end term of the investment agreement for vested shares SPV would be liquidated.

Questions?

For any inquiries regarding the Simpleros investment campaign, please send your questions to [email protected].

Santa Lemsa, with more than 15 years in finance and fintech, leads Simpleros as its Founder and CEO. Her main focus has been on creating automated systems for decision-making and risk management. Her deep knowledge in analytics and product development has played a crucial role in Simpleros' success in the competitive Spanish online lending market. Santa's leadership is marked by her ability to drive growth and his commitment to customer-centric financial solutions.

Daiga Pauzere brings over five years of global experience in analytics, product development, and process automation. She excels in evaluating and improving business processes and systems. Her expertise in data analysis helps in managing risks and optimizing operations. Daiga's role in Simpleros focuses on making processes efficient and reducing dependency on manual work, ensuring a secure and effective business environment.